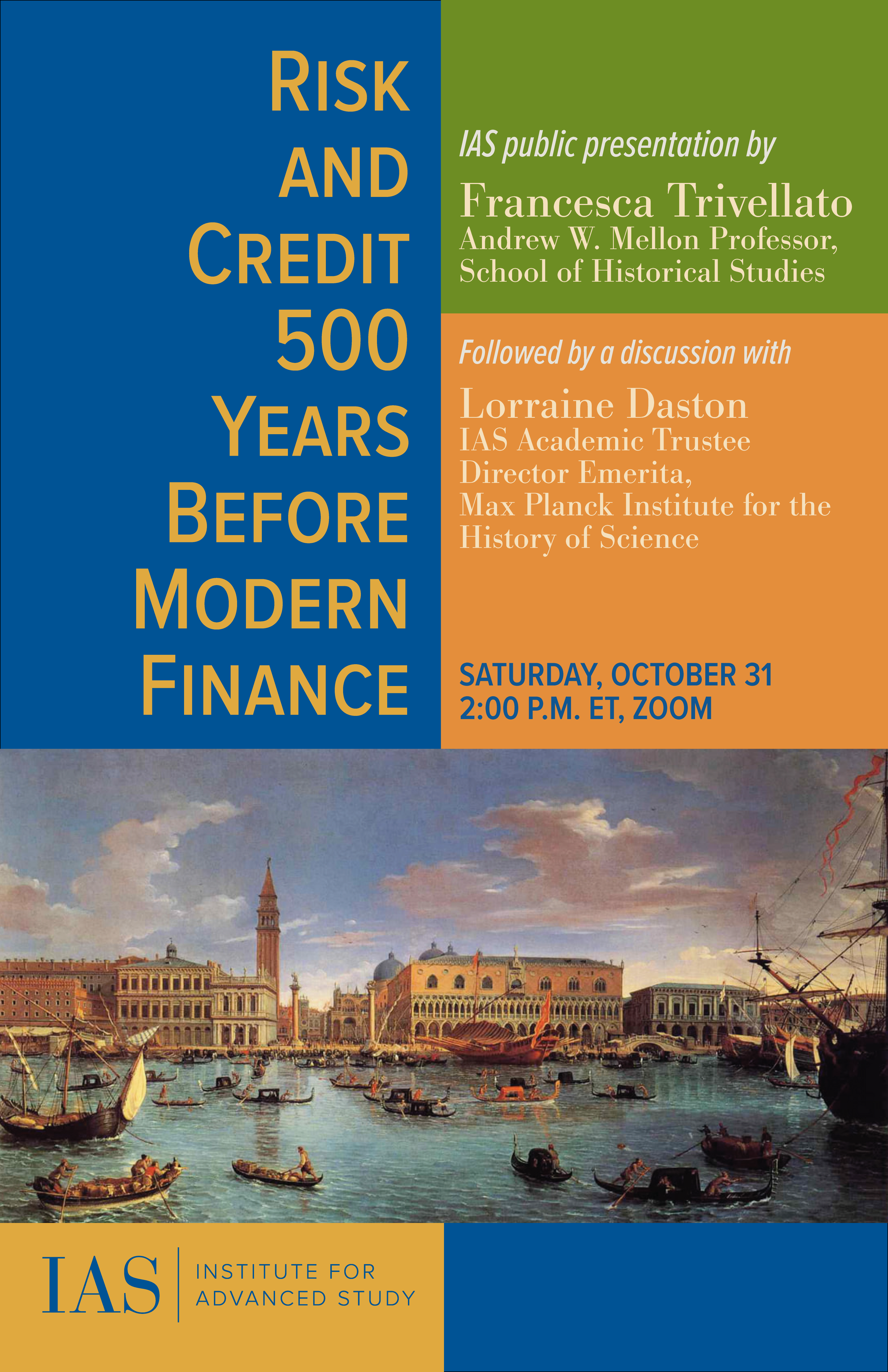

IAS public presentation by Professor Francesca Trivellato

In most of today’s advanced economies, access to information and anti-discrimination legislation are as robust as they have ever been in the history of human kind. And yet, wealth and income inequality are on the rise, structural discrimination persists, and the complexity of financial markets accentuates asymmetric information. The roots of these phenomena are deep. Around 1500, legal and technological barriers for both borrowers and lenders were staggering. How did European merchants tame those risks while plying seas and oceans under conditions of radical uncertainty? The panel will discuss two financial instruments, bills of exchange and insurance, and efforts at quantification that developed in pre-modern Europe in relation to the social hierarchies and scientific knowledge of the time. These innovations broadened societal participation in commerce and boosted the growth of international trade, but also intensified fears of oligopolies and coexisted with religious prejudice. At a moment when societies have once again been plunged into uncertainty and we are once again weighing risks on a case-by-case basis, the pre-modern experience has lessons to teach us.